Public Service Loan Forgiveness (PSLF) helps erase remaining federal student loan debt for those working in qualifying public service jobs after 120 qualifying payments. Here's a quick breakdown:

- Who Qualifies? Full-time employees of government agencies, 501(c)(3) nonprofits, or certain other nonprofits.

- Eligible Loans: Only Direct Loans qualify. Older federal loans like FFEL or Perkins must be consolidated into a Direct Consolidation Loan.

- Repayment Plans: Income-Driven Repayment (IDR) plans or the standard 10-year repayment plan are required.

- Key Requirements: Payments must be on time, in full, and made while working for a qualifying employer.

Recent updates include tools like the PSLF Help Tool to check eligibility and track progress. A one-time adjustment (available until early 2025) may also count past payments toward forgiveness.

Steps to Apply:

- Certify employment annually using the Employment Certification Form (ECF).

- Consolidate ineligible loans and select a qualifying repayment plan.

- Track your payments and submit your PSLF application after 120 qualifying payments.

Stay organized, verify employer eligibility, and use tools like StudentAid.gov to simplify the process.

What is PSLF? | Tips for Public Service Loan Forgiveness

Who Qualifies for PSLF

To qualify for the Public Service Loan Forgiveness (PSLF) program, you need to meet three main criteria: work for a qualifying employer, have eligible federal loans, and make payments under an approved repayment plan. Each of these requirements has specific details that determine your eligibility for loan forgiveness.

Qualifying Employment

Your employer, not your job role, determines if you qualify for PSLF. Government agencies at the federal, state, local, or tribal levels typically qualify, provided you meet the full-time work requirement. For nonprofit organizations, 501(c)(3) tax-exempt organizations automatically qualify. Other nonprofits may also qualify if they provide certain public services. If you work multiple part-time jobs for qualifying employers, you can combine the hours to meet the full-time threshold, as long as each job is at least 10 hours per week. However, private companies, labor unions, partisan political organizations, and for-profit organizations generally do not qualify.

Once you confirm your employment eligibility, the next step is to verify your loan type.

Eligible Loans

Only Direct Loans are eligible for PSLF. These include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans. If you have older federal loans, such as those from the Federal Family Education Loan (FFEL) Program or Federal Perkins Loans, you’ll need to consolidate them into a Direct Consolidation Loan to qualify. Keep in mind that consolidating loans resets your count of qualifying payments. However, a temporary one-time Income-Driven Repayment (IDR) account adjustment (available through early 2025) allows eligible payments made since October 2007 to count, even those during the pandemic payment pause from March 2020 to September 2023.

Private student loans, regardless of the repayment plan or lender, are not eligible for PSLF.

After confirming your loan type, it’s essential to choose the right repayment plan to maximize your forgiveness opportunities.

Approved Repayment Plans

The repayment plan you choose plays a key role in your PSLF eligibility and the amount of loan forgiveness you may receive. Qualifying repayment plans include all Income-Driven Repayment (IDR) plans and the 10-year Standard Repayment Plan. The IDR plans include:

- Income-Based Repayment (IBR) Plan

- Income-Contingent Repayment (ICR) Plan

- Pay As You Earn (PAYE) Plan

- Saving on a Valuable Education (SAVE) Plan

These plans calculate your monthly payment based on your income and household size, often resulting in lower payments compared to the standard option. While the 10-year Standard Repayment Plan is technically eligible, it typically results in full loan repayment without forgiveness unless extended through qualifying deferments.

Non-qualifying repayment plans include the Standard Repayment Plan for Direct Consolidation Loans, Graduated Repayment Plan, and Extended Repayment Plan. To increase your chances of forgiveness, it’s best to choose an IDR plan that offers the lowest monthly payment. Keep in mind that IDR plan eligibility can vary based on your financial situation, and your payments may increase as your income grows. The federal Loan Simulator tool is a helpful resource for comparing repayment plans and understanding their impact on your monthly payments and forgiveness potential.

A temporary opportunity exists through the one-time IDR account adjustment. Under this adjustment, any payments made on federal loans while working for a qualifying PSLF employer since October 2007 will count toward forgiveness, regardless of your repayment plan. Borrowers should wait until their accounts reflect this adjustment - expected by fall 2024 - before making further PSLF-related decisions.

How to Apply for PSLF

Applying for Public Service Loan Forgiveness (PSLF) involves several steps, beginning with certifying your employment and ending with your final forgiveness application after making 120 qualifying payments. Here’s how to navigate the process.

Certifying Employment

Start by submitting the Employment Certification Form (ECF) soon after beginning qualifying employment and continue to file it annually. While not mandatory until you apply for forgiveness, submitting it yearly helps confirm your employer’s eligibility and ensures your progress is tracked accurately.

The ECF requires details like your employment dates, job title, and average weekly hours. It must be signed by an authorized official from your employer, typically someone in human resources. Submitting this form regularly allows the Department of Education to update your qualifying payment count and flag any potential issues with your loans or repayment plan early, saving you headaches down the road.

If you switch jobs within the public service sector, submit a new ECF for each new employer. The form covers your entire employment with a single organization, so you only need to resubmit for the same employer if there’s a significant change in your job status.

Once your employment is certified, the next step involves consolidating any ineligible loans and choosing the right repayment plan.

Consolidating Loans and Selecting a Repayment Plan

If you have non-Direct federal loans, you’ll need to consolidate them into a Direct Consolidation Loan to qualify for PSLF. You can apply for consolidation through your loan servicer or the Federal Student Aid website. While consolidating, continue making regular payments to avoid falling behind.

After consolidation, pick a repayment plan that qualifies for PSLF. Many borrowers find the SAVE Plan offers the lowest monthly payments, but depending on your financial situation, another income-driven repayment plan might work better. Your loan servicer will calculate your payment amount based on your latest tax return and family size.

Timing matters here. If you’ve already made qualifying payments on some Direct Loans, consolidating them with non-Direct loans will reset your payment count to zero. To avoid setbacks, consult your loan servicer before consolidating. Additionally, remember to update your income information annually for income-driven repayment plans. Missing this recertification could lead to higher payments or disqualified payments.

Once your loans are consolidated and your repayment plan is set, maintain detailed records to ensure every payment counts toward forgiveness.

Tracking Qualifying Payments

Keeping a close eye on your payment progress is essential. Track payment dates, amounts, your employment status, and repayment plan details using a spreadsheet or digital tool. This will help you stay organized and ensure nothing falls through the cracks.

Federal Student Aid offers online tools to verify your payment count and generate pre-filled forms for employment certification and forgiveness applications. Regularly check your account to confirm that your payments are being correctly counted and that your employment information is up to date.

For a payment to qualify, it must be made on time and in full. You can’t speed up the process by making extra payments in the same month. Setting up automatic payments can help you stay consistent and may even lower your interest rate slightly.

Pay attention to communications from your loan servicer, especially if your loans are transferred to a new servicer. Verify that your payment history and qualifying payment count transfer correctly, and ensure your repayment plan remains suitable for PSLF.

By staying proactive and keeping accurate records, you’ll be well-prepared when it’s time to apply for forgiveness.

Submitting Your Application

Once you’ve made 120 qualifying payments, you can submit your PSLF application. This form combines your employment certification with your forgiveness request and requires signatures from all qualifying employers where you made payments toward the 120-payment requirement.

Gather supporting documents like employment verification letters, pay stubs, and tax forms before applying. If you worked for multiple qualifying employers, ensure you have updated contact information for each organization’s HR department in case additional verification is needed.

While your application is being processed, continue making your regular payments and maintain your qualifying employment. If your application is denied, don’t panic - common issues like missing payments or documentation errors can often be resolved through the reconsideration process.

If approved, your remaining federal loan balance will be forgiven, and your loan servicer will send you a confirmation. Under current federal law, the forgiven amount is not taxable, offering financial relief without added tax burdens.

sbb-itb-3a8c5bf

Common Mistakes and How to Avoid Them

Navigating the PSLF process can be tricky, but understanding some common missteps can save you a lot of headaches - and wasted time. Here’s a closer look at the biggest pitfalls and how to steer clear of them.

Ineligible Loans or Employers

Not all loans or employers qualify for PSLF, which can catch many people off guard. Only Direct Loans are eligible, so if you have Federal Family Education Loan (FFEL) Program loans, Perkins Loans, or private loans, they won’t count. However, you can consolidate these into a Direct Consolidation Loan to make them eligible - just be aware this resets your payment count to zero.

Similarly, not all employers qualify. Your employer must be a U.S. federal, state, local, or tribal government organization, or a 501(c)(3) tax-exempt nonprofit. However, some organizations that seem like they’d qualify - like labor unions, partisan political groups, or certain religious entities - don’t meet the requirements.

To avoid confusion, use the Federal Student Aid PSLF Help Tool to confirm your employer’s eligibility. If your employer isn’t listed, ask your HR department for a letter verifying their tax-exempt status under section 501(c)(3) of the Internal Revenue Code. And don’t wait - log into your Federal Student Aid account to confirm your loan types and contact the Federal Student Aid Information Center at 1-800-433-3243 if you’re unsure about your loan details.

Missed Payments or Incorrect Amounts

Timing and accuracy are everything when it comes to qualifying payments. Even one late or partial payment can disqualify that month from counting toward your 120-payment goal. Payments must be made in full and on time.

To avoid missing a payment, consider enabling automatic payments. Not only does this ensure your payments are timely, but most loan servicers also offer a 0.25% interest rate discount as an added bonus. If you prefer making manual payments, set reminders and pay at least five business days before your due date to account for processing time.

Another common misconception is that making extra payments in the same month will help you finish faster. Unfortunately, it doesn’t work that way - only one qualifying payment per month counts. Instead, stick to your monthly payment schedule and redirect any extra funds toward building an emergency fund or tackling other financial goals.

Finally, don’t overlook annual income recertification. If you miss the deadline, your payments could increase, which might strain your budget. While higher payments still count toward PSLF, it’s a good idea to set a reminder six weeks before your recertification deadline to gather your tax documents and complete the process early.

Documentation Errors

Paperwork mistakes can cause unnecessary delays in your PSLF journey. One common issue is submitting incomplete or incorrect Employment Certification Forms (ECFs). Missing signatures, incorrect employment dates, or failing to include your Social Security number are frequent errors. Make sure your HR representative - usually someone in human resources or your direct supervisor - completes and signs the form accurately.

If you’ve changed your name due to marriage or other reasons, ensure your loan servicer has your updated information before submitting your ECF. Include any legal documentation of the name change to avoid processing issues.

Keeping track of your progress is also crucial. Create a simple spreadsheet to log your payment dates, amounts, employment periods, and ECF submission dates. Store digital copies in cloud storage and keep physical backups in a safe place. This personal record can help you catch discrepancies early and provide proof if your loan servicer’s records are incomplete.

Submitting your first ECF too late is another common mistake. While you’re not required to submit employment certification until you apply for forgiveness, doing so annually - or whenever you change jobs - can help identify and resolve issues early. Aim to submit your first ECF within 90 days of starting qualifying employment, then continue to update it yearly. This proactive approach ensures your payment count remains accurate and gives you confidence that you’re on track for forgiveness.

Tools and Resources for PSLF

Tackling the challenges of Public Service Loan Forgiveness (PSLF) becomes much easier with the right tools and resources. The government offers several official platforms to help you navigate the process and avoid unnecessary mistakes.

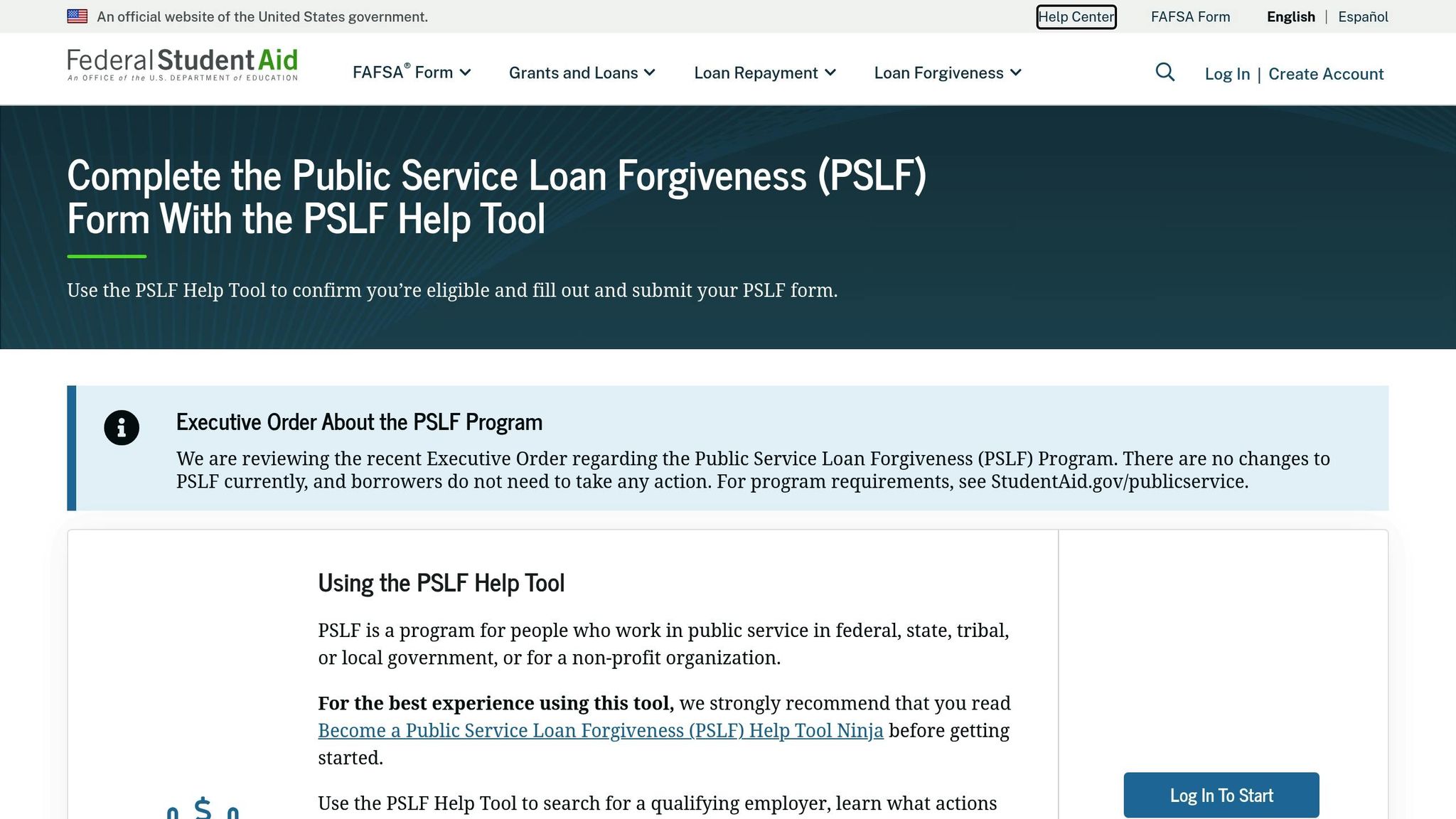

PSLF Help Tool and Employer Search

The PSLF Help Tool on StudentAid.gov is a key resource provided by Federal Student Aid. It simplifies the application process by allowing you to check your employer's eligibility and submit forms online.

The tool’s employer search feature uses an updated database to verify whether your employer qualifies for PSLF. To get the best results, have your employer’s Federal Employer Identification Number (EIN) ready before searching. If your employer isn’t listed or appears as "undetermined", you can manually input their details and upload your W-2 for faster review.

Additionally, the tool enables digital submission of your PSLF form. Once completed, you can send the form directly to your employer’s authorized official for a digital signature, skipping the hassle of printing, mailing, or scanning documents. When you submit the form, your HR department will receive an email from dse_NA4@docusign.net for signature.

"For faster processing, we highly recommend you complete, sign, and submit your PSLF form online." – Federal Student Aid

After submission, you can track your form’s status in the "My Activity" section of your StudentAid.gov account. This feature provides real-time updates on your application’s progress, ensuring you stay informed every step of the way.

Use LoanDebtFix for Expert Support

Even with government tools, navigating PSLF can be tricky, especially when dealing with loan consolidation, employment changes, or other complexities. This is where LoanDebtFix steps in to provide professional guidance tailored to your PSLF needs.

Their experts can help you:

- Confirm loan eligibility.

- Choose the best repayment plan based on your income.

- Address discrepancies in your qualifying payment count.

- Ensure all paperwork is accurate and submitted correctly.

By using LoanDebtFix, you can avoid delays and save time. The platform also lets you search for experts by location or service type, making it easy to find someone familiar with PSLF requirements and your local employment landscape.

Government Forms and Calculators

The U.S. Department of Education has centralized all PSLF-related activity on StudentAid.gov, streamlining access to essential tools and forms. This makes it easier to stay organized and monitor your progress.

Through your StudentAid.gov account, you can access:

- PSLF/TEPSLF Payment Progress: This section shows your progress toward forgiveness. As of fall 2024, it also includes PSLF credits for eligible deferment or forbearance periods.

- IDR Payment Count Tracker: Launched in January 2025, this tool helps you track progress toward income-driven repayment forgiveness, if applicable.

"Submitting a PSLF form every year is the best way to validate your progress and stay on track for PSLF." – Federal Student Aid

When you reach your 120th qualifying payment, you can use the same PSLF form through the Help Tool to request forgiveness. The system will guide you through the final steps, ensuring all requirements are met before submission.

While your forgiveness request is under review, continue making regular payments. Alternatively, contact your loan servicer to discuss PSLF-related forbearance to prevent any unnecessary delays.

Conclusion

The Public Service Loan Forgiveness (PSLF) program provides a pathway to debt relief for federal student loan borrowers working in qualifying public service roles. However, achieving forgiveness requires careful planning and attention to detail.

To stay on track, it’s essential to keep thorough records of certified payments, employment updates, and consolidation decisions. Even small missteps - like working for a non-qualifying employer or choosing the wrong repayment plan - can lead to delays or additional costs.

Start early by submitting your Employment Certification Form every year and tracking your progress on StudentAid.gov. Don’t rely solely on your loan servicer for guidance. Instead, take advantage of tools like the PSLF Help Tool to confirm employer eligibility and submit forms digitally. These proactive measures are key to navigating the process smoothly.

When it comes to loan consolidation, employment changes, or payment discrepancies, seeking expert advice can make a big difference. Professional guidance can help resolve issues quickly and ensure your progress stays on course.

In short, patience and precision are your greatest allies in the journey toward financial freedom. With the right strategies and resources, you can join the many public servants who have successfully erased their federal student loan debt through PSLF.

FAQs

What can I do if I realize my employer doesn’t qualify for Public Service Loan Forgiveness after making payments?

If you find out that your employer doesn’t meet the requirements for Public Service Loan Forgiveness (PSLF) after you’ve been making payments, don’t panic. Start by submitting an employer certification form to double-check their eligibility. This step can clear up any confusion and confirm whether your employer qualifies for the program.

If it turns out your employer isn’t eligible, you still have options. You could consider transitioning to a qualifying employer if PSLF is a priority for you. Another route might be exploring other loan forgiveness programs or repayment plans that better suit your circumstances. Staying proactive and regularly reviewing your progress is key to making sure you’re moving in the right direction.

How can I make sure my past payments count toward Public Service Loan Forgiveness (PSLF) with the temporary IDR adjustment?

To make sure your past payments count toward Public Service Loan Forgiveness (PSLF) under the temporary Income-Driven Repayment (IDR) adjustment in 2025, start by reviewing your payment history in the federal student aid system. The Department of Education’s one-time adjustment will credit qualifying payments made as far back as July 1, 1994, even if they were made before enrolling in an IDR plan.

You should also submit an Employment Certification Form every year or whenever you switch jobs. This form confirms your qualifying employment and helps track your progress toward loan forgiveness. To stay on top of things, contact your loan servicer to verify your payment count and address any discrepancies. Taking these steps now can ensure all eligible payments are properly credited.

What should I do if my PSLF application is denied because of errors or missing payments?

If your PSLF application gets denied, don’t panic - start by reviewing the reason for the denial carefully. Double-check your records to make sure all the necessary paperwork is accurate and complete.

If the denial stems from errors, gather any missing or corrected documents and go through the PSLF reconsideration process to challenge the decision. For issues related to missing payments, confirm if those payments meet the program's criteria. If they don’t, you may need to make additional qualifying payments. Reaching out to your loan servicer can also provide clarity and guidance on how to fix the problem.

Acting quickly and following the proper steps can help you stay on track toward achieving loan forgiveness.